Master's in Taxation

Become a professional with a high level of expertise in national and international taxation

Objective

The Master's in Taxation program arises from the need to address the growing demands of organizations that require increasingly skilled personnel in the efficient management of tax aspects affecting them, as well as their correlation with other organizations, government entities, and even their operational relations in other countries. Therefore, a master's-level program not only provides professionals with the opportunity to stay updated but also equips them with the theoretical and practical foundations necessary to better develop their professional activities.

Why study with us?

Flexible Schedules

Duration of 2 years

Innovation

High Educational Level

Program

Admission Profile

Academic Degree.

Applicants must hold a bachelor's degree, preferably in a field related to the master's program, with a minimum general grade point average of eighty.

Knowledge.

Desired general knowledge:

- Computing

- Research Methodology

- Law

- Accounting

Skills and Attitudes.

Candidates are required to have the following skills:

- Proficiency in using computers and software such as word processors, presentation software, and spreadsheets.

- Ability to work in multidisciplinary teams.

- Strong reading, writing, and text comprehension skills, as well as effective oral and written communication.

- Competence in handling computer equipment and support software.

Other.

A minimum of two years of professional experience in the relevant field is required. This criterion will be evaluated through the selection process.

Graduate Profile

Graduates of this program will be high-performance, top-level professionals, qualified to work as executives and/or consultants in both public and private companies. They will be capable of formulating and implementing strategies and guidelines in the fiscal area, solving problems with an ethical and creative approach, and contributing to the development and dissemination of knowledge in the field. They will act as agents of change, with critical thinking skills, a holistic vision, and a continuous focus on responsible knowledge creation, committed to social well-being.

- Apply, formulate, and implement strategies and guidelines in the fiscal area.

- Solve problems with an ethical and creative approach.

- Contribute to the development of knowledge in the field and its dissemination.

- Apply knowledge in decision-making, considering the environment and its broader impact.

- Generate and implement strategic and tactical plans for the organizations they work with.

- Join interdisciplinary teams and apply their expertise in different functional areas.

- Identify problems and proactively promote solutions using appropriate methods and procedures.

- Resolve problems with an ethical perspective, considering their social impact.

Occupational Field

A graduate of the Master’s in Taxation will be able to work in the following areas:

- As an advisor.

- Public servant in a field related to taxation.

- Consultant.

- Working in international organizations.

- Social, governmental organizations, and educational institutions.

- University professor.

Convocatoria Cerrada

Important Dates

Knowledge Exam

7 de Noviembre de 2025

Application for Admission

10 de Octubre de 2025

Interview

Del 24 al 27 de Noviembre de 2025

Results

5 de Diciembre de 2025

Proceso de inscripción

Enero de 2026

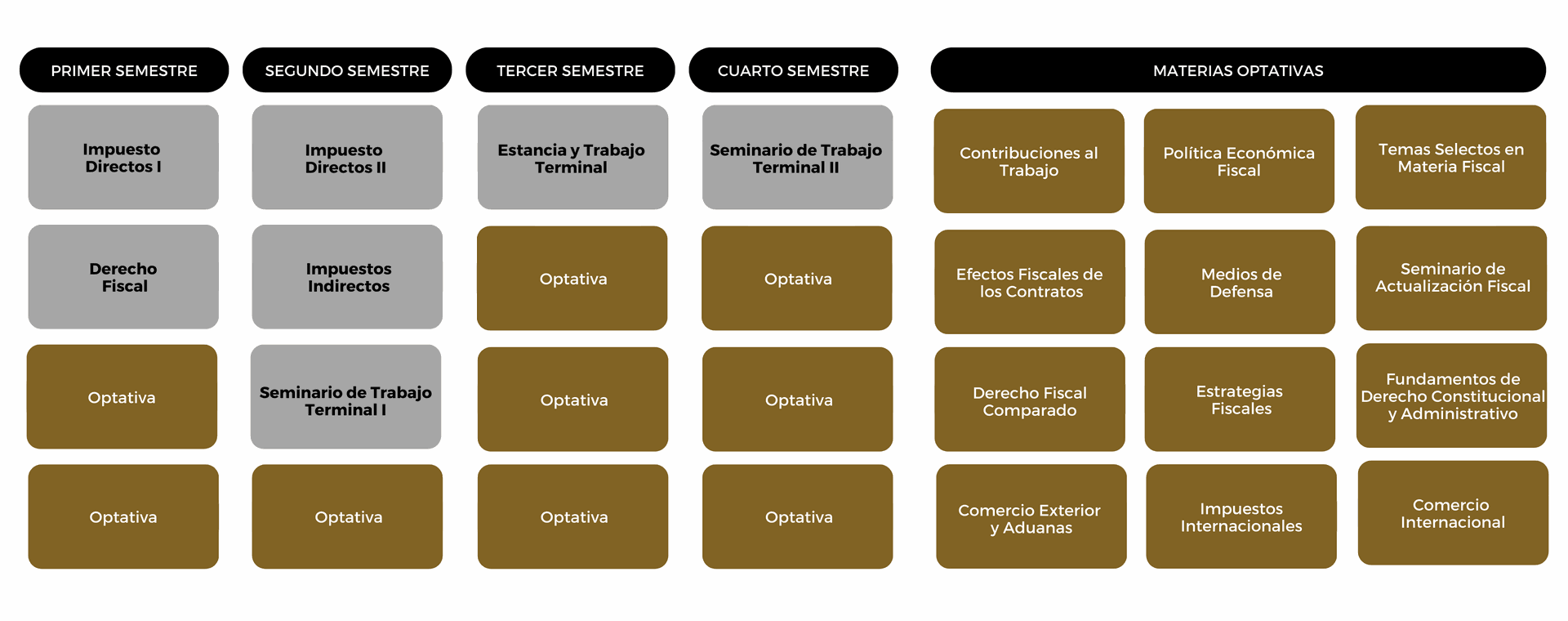

Curriculum Map

Lines of generation

Tax and Financial Information Systems

Tax Strategies for Competitiveness

Fiscal and Financial Analysis for the Development of SMEs

Teaching staff

PhD. Adolfo Solís Farías

Partner at Grupo Farías, Tax Attorneys

PhD in Tax Law from the University of Castilla-La Mancha, Spain

Member of the Academy of Fiscal Studies of Baja California

Mtro. Iván Curiel Villaseñor

Partner at TP Legal Group

Master's Degree in Law with a Specialization in Public Law from Universidad Anáhuac

Judge of the Specialized Chamber in Administrative Responsibilities and Anti-Corruption at the State Administrative Justice Tribunal of Baja California

Mtro. Fausto Hernández Loaiza

Managing Partner of HN Fiscal y Asociados, S.C.

Master's Degree in Taxation from the Instituto de Especialización para Ejecutivos, A.C.

Specialist in Transfer Pricing

Member of the Fiscal Studies Academy of Baja California

Mtro. Joel López Herrera

Promotion and Services Manager at Agencia Aduanal Pérez Ortiz, S.C.

Master's Degree in Accounting and Specialization in Taxation from UABC

Member of the Foreign Trade Committee at INDEX (Maquiladora Industry Association, Tijuana)

PhD. Alberto Mejía Garduño

Partner in charge of Taxes at the Tijuana and Mexicali offices of KPMG Doctorate in Administrative Sciences and Specialization in Taxation Member of the Academy of Tax Studies of B.C.

PhD. Omar Caballero Ulloa

Manager of Tax and Administrative Litigation

Specialist in: Tax, Accounting; Tax, Administrative, and Anti-Money Laundering Defense; Amparo; Corporate and Civil Law at CR&C Tax Consultants

Doctorate in Tax Sciences from the Institute of Specialization for Executives

Mtro. Jorge Neptali de la Cruz

Partner at JR DE LA CRUZ, S.C.

Master's in Accounting from UABC

Member of the Academy of Tax Studies of Baja California

Mtro. Juan Carlos Escarrega Rojo

Managing Partner at RSM México Bogarín S.C.

Master's in Taxation from the Institute of Specialization for Executives

Tax

Partner at the RSM office in Hermosillo, responsible for developing corporate financial, tax, and legal strategies.

PhD. Armando Álvarez Carmona

Managing Director at Álvarez Carmona y Asoc., S.C., overseeing practices in international tax matters, corporate governance, family businesses, and estate succession, serving clients in Mexico and the United States.

Master's in Mediation and Conflict Resolution from the International University of Valencia, Spain.

Member of the Academy of Fiscal Studies of Baja California.

Mtra. Guadalupe Sánchez Lorenzano

Managing Partner at Sánchez Lorenzano y Asociados SC

Master's in Taxation from the Institute of Specialization for Executives

Founder of the Social Security Commission at the College of Public Accountants of Baja California, A.C.

Mtro. Federico Solorzano Parra

Partner in the Tax Area at KPMG

Master's in Taxation from the Institute of Training of the West

Member of the Academy of Fiscal Studies of B.C.

Mtra. Sarah Elizabeth Chavez de la Mora

Abogada postulante en el área Fiscal y Administrativa en el Despacho Corporativo FORTIS

Presidenta de la Academia de Derecho Fiscal del Estado de Baja California

Maestra en Ciencias Jurídicas con énfasis en Derechos Humanos por la Universidad Autónoma de Baja California

Linkage

Indicators

Enrollment

205

Graduation Rate

45%

Dropout Rate

14%

Graduation Efficiency

68%

Coordination

Ensenada

Faculty of Administrative and Social Sciences

PhD. Oscar Galván Mendoza

ogalvan68@uabc.edu.mx

Phone. (646) 176-66-00 Ext. 144

Tijuana

Faculty of Accounting and Administration

Dr. Sergio Octavio Vázquez Núñez

maestriaimpuestos.fcatij@uabc.edu.mx

Tel. (664) 979-75-00 Ext. 55110

Mexicali

Faculty of Administrative Sciences

PhD. Berenice Martínez López

berenice.martínez.perez@uabc.edu.mx

Phone. (686) 841-82-22 Ext. 45064 y 45068