Bachelor's Degree in Accounting

"Contribute to society by developing professionals with comprehensive training, through education and continuous updating, performing at a competitive level to design, analyze and administer qualitative and quantitative accounting and financial information systems, which allow the proper management of resources. organizations and facilitate decision-making in order to respond to demands from their environment"

About LC

New Admitted

El estudiante que desee ingresar al programa educativo Licenciado en Contaduría, deberá poseer las siguientes características:

GENERAL KNOWLEDGE IN:

- Matemáticas.

- Informatics.

- General culture.

HABILIDADES:

- Oral and written communication.

- Handle numeric data.

- Orden y organización.

- Teamwork.

- Adaptación a los diferentes entornos.

- Capacidad de síntesis.

ACTITUDES:

- Interest in administrative accounting areas.

- Proactivo en el trabajo de equipo.

VALORES:

- Responsibility.

- Commitment.

- Honestidad.

- Respeto.

Graduate

El egresado del programa educativo Licenciado en Contaduría, es un profesionista con una formación sólida que aplica conocimientos contables, financieros, científicos, tecnológicos y de administración y auditoría, conforme a la normatividad aplicable, para solucionar problemáticas de su propia disciplina.

El Licenciado en Contaduría será competente para:

- Diseñar e implementar un sistema de información financiera mediante la utilización de la normatividad contable nacional e internacional, para que brinde apoyo a la toma de decisiones en las entidades económicas y a usuarios de la información, con objetividad, oportunidad y principios éticos profesionales.

- Gestionar los recursos de una entidad económica desde una perspectiva global a través de la aplicación de métodos, técnicas y herramientas financieras para lograr la optimización de sus recursos, con honestidad, trabajo colaborativo y responsabilidad social.

- Aplicar las disposiciones fiscales y legales vigentes que le son relativas a una entidad económica mediante el análisis de las normas correspondientes para el cumplimiento de sus obligaciones tributarias y legales, con integridad y confidencialidad.

- Auditar entidades económicas con base en las normas y disposiciones aplicables para emitir opiniones a través de informes que apoyen a las entidades económicas en la toma de decisiones, con diligencia, imparcialidad e integridad.

Occupational Field

Los egresados del programa educativo Licenciado en Contaduría podrán desempeñarse en los ámbitos local, estatal, nacional e internacional realizando actividades de los siguientes sectores:

SECTOR PÚBLICO

Dependencias y entidades integrantes de la administración pública federal, estatal o municipal como: administrador, contador, financiero, auditor, contralor, fiscalista.

SECTOR PRIVADO

En entidades de sectores industrial, comercial y servicios como: contador, contralor, financiero, fiscalista, auditor.

COMO PROFESIONAL INDEPENDIENTE

- Auditor.

- Asesor y/o consultor contable administrativo y fiscal.

- Perito contable.

- Servicios contables, fiscales, financieros y de auditoría.

Educational Plan

Basic Stage

In this stage it establishes the foundations of the educational program, it comprises a set of multidisciplinary general learning units, with a formative orientation that provides the student with the contextual, methodological and instrumental bases fundamental for the administrative area, necessary for the understanding of the origin and the location of the learning units of the disciplinary stage. This stage favors the integration of a common core that consists of a set of learning units belonging to a group of related careers in the same area of knowledge.

Competence

Analyze the basic and technical concepts of the areas of economic-administrative sciences through the acquisition of general knowledge of other disciplines, basic areas of knowledge and of the social and human sciences that allow them to develop skills, attitudes and values.

Disciplinary Stage

The student will acquire the theoretical, methodological and technical knowledge of the Administration, oriented to a generic learning for professional practice. It also includes the development of generic skills transferable to professional performance common to a specific occupational field.

Competence

Apply theoretical and methodological concepts, through the implementation of systems, procedures and methods in the accounting area for the generation of useful information for an economic entity, in a responsible manner.

Terminal Stage

The specific knowledge of computer science is reinforced, the application of the acquired knowledge is carried out in an integrated way, increasing the practical work, and it is concluded with the development of the professional skills necessary to join the occupational field, for the generation of alternatives and troubleshooting.

Competence

Design and evaluate economic-administrative systems by integrating methods, techniques and procedures of accounting to responsibly issue opinions, recommendations and make accounting, financial, fiscal and administrative decisions of an economic entity.

Some data about LC

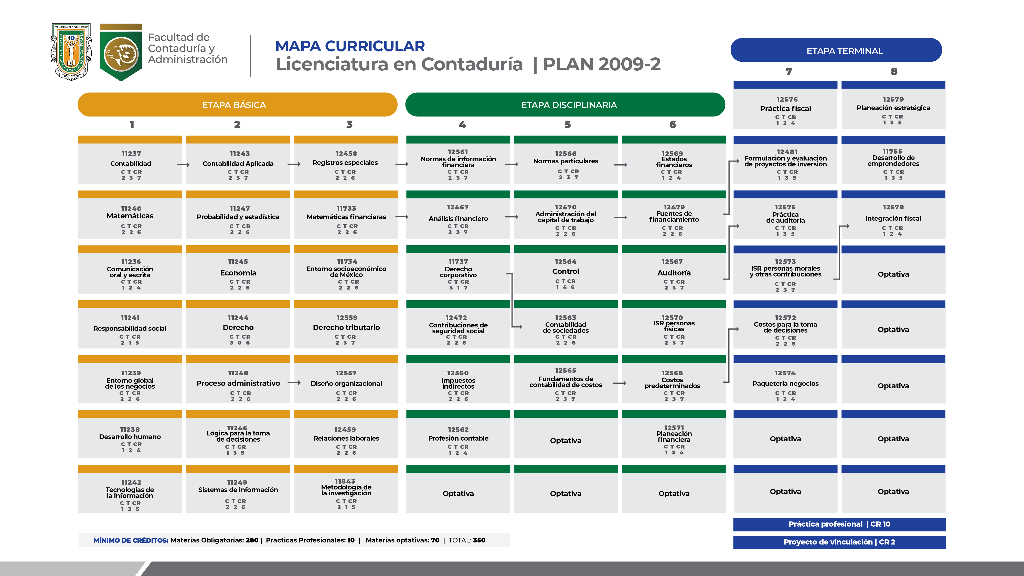

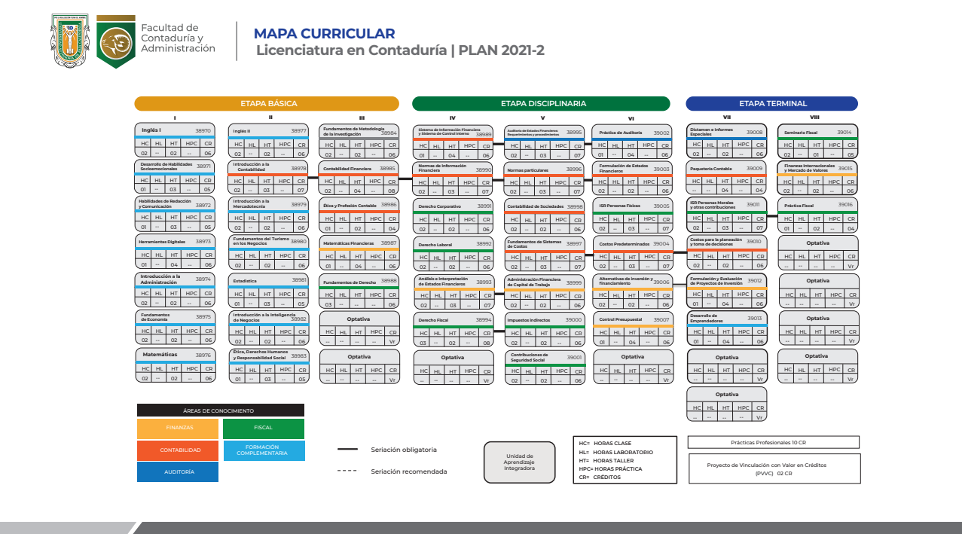

Curriculum Maps

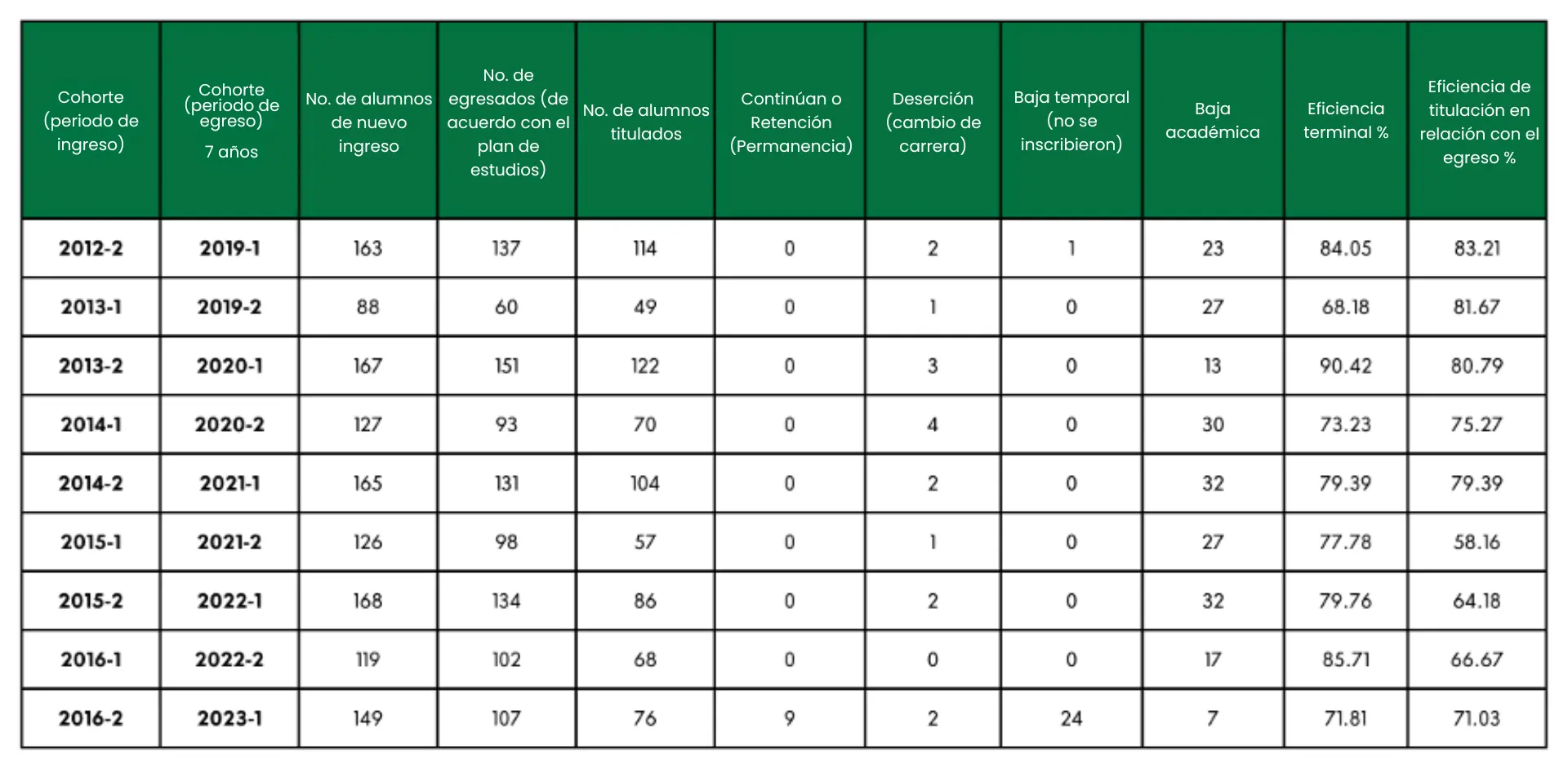

Quality Indicators

Coordination

PhD. Zurisaddai Rubio Arriaga

- LC Coordinator

- Ext. 55045

- Email:rubio.zurisaddai@uabc.edu.mx

PhD. Malena Portal Boza

- Finance Area Coordinator

- Ext. 55122

- Correo: mportal@uabc.edu.mx

PhD. Bianca Janeth López Campillo

- Coordinator Basic Accounting Area

- Ext. 55025

- Correo: bianca.janeth.lopez.campillo@uabc.edu.mx

Ms. María Soledad Plazola Rivera

- Coordinator of the Basic and Advanced Accounting Area

- Ext. 55067

- Correo: splazola@uabc.edu.mx

Prof. Julio Octavio Blas Flores

- Tax Area Coordinator

- Ext. 55066

- Email: jblas@uabc.edu.mx